Payback Period Concept

Payback period represents the time it

takes to recover the invested amounts through cash-flows generated by

that same investment (a lot used with one of the key indicators in

viability analysis studies). By other words, represents the time needed

so that the Net Present Value (NPV) reaches positive values. To update

future cash-flows is used a rate to which is called discount rate. This

discount rate isn’t more than an interest rate without risk (usually are

used OT’s interest rates) added an established risk prize for the type

of projects at stake.

Due to the easiness of comprehension, the

investment recovery term is one of the preferred indicators by the

businessmen.

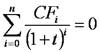

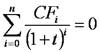

Calculation formula:

CFi = Cash-flow in the year i

t = Discount rate

n = Payback period

Being this equation of difficult

mathematic calculation (its resolution is only possible by successive

approaches) are usually used computer means.

Translated from Portuguese

by Susana Saraiva, Portuguese-English and English-Portuguese translation

specialist. Contact: spams@sapo.pt.